Introduction

In his book “The New Trading for a Living,” Professor Alexander Elder mentioned that many traders fail due to a mathematical blind spot. New traders either don't understand or misinterpret some fundamental mathematical principles in trading, leading to difficulties in their trading journey.

This article will cover the necessary mathematical formulas for those who are serious about trading.

1. Margin

If you've participated in the FOREX market, leveraging is crucial. Contract sizes in Forex are calculated in Lots, and 1 Lot = 100,000 units. Retail forex traders don’t typically have enough in their accounts to buy or sell $100,000 at a time, so leverage becomes a vital tool.

In the cryptocurrency market, margin trading is increasingly popular, especially with futures contracts. For instance, you can use just $1 of your own margin to trade up to 100x or 150x the amount of capital you have.

Leverage Calculation:

Leverage = 1 / Margin

Example:

Leverage = 50:1 = 1 / 2% = 1 / 0.02

This means if you’re using a 2% margin rate, your trade can move 100% up or down for just a 2% price fluctuation from your entry.

Example Calculation:

If you go long on BTC at $10,000 with 50x leverage and a $1,000 margin, you would be able to control 5 BTC. If BTC price rises by $200 (2%), you would gain $1,000; if it drops by $200, you lose $1,000.

Key Takeaway: While the upside may seem unlimited, higher leverage dramatically increases the likelihood of margin calls. The higher the leverage, the higher the chance of liquidation.

2. Position Sizing Calculation

Follow these 4 steps to calculate your trade position size:

- Account size (e.g., $50,000)

- Risk percentage per trade (e.g., 2%)

- Buy price of the coin (e.g., $45)

- Stop-loss price (e.g., $40)

Step-by-Step Calculation:

- Step 1: Calculate the risk per trade.

Risk = Account size x Risk percentage per trade

Risk = $50,000 x 2% = $1,000 - Step 2: Calculate the loss percentage.

Loss percentage = 1 - (Stop-loss price / Current price)

Loss percentage = 1 - (40 / 45) = 11% - Step 3: Calculate position size.

Position size = Risk / Loss percentage

Position size = $1,000 / 11% = $9,090 - Step 4: Calculate the number of coins to buy.

Number of coins = Position size / Current price

Number of coins = $9,090 / $45 = 202 coins

3. Mathematical Expectancy (Edge)

To calculate the mathematical expectancy of your trading system, you need the following:

- Win rate (e.g., 60%)

- Account size (e.g., $50,000)

- Risk per trade (e.g., 1%)

- Risk/Reward ratio (e.g., 2:1)

Formula for Expectancy:

Expectancy = Win rate x (Account size x Risk per trade x Risk/Reward) - Loss rate x (Account size x Risk per trade)

Example:

Expectancy = 60% x ($50,000 x 1% x 2) - 40% x ($50,000 x 1%) = $400

This system would yield an average profit of $400 per trade.

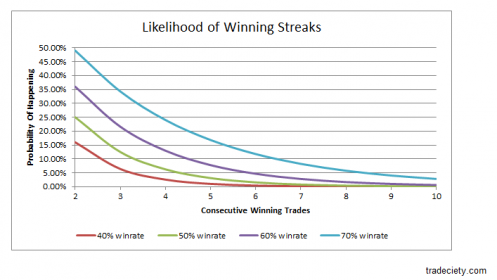

4. Probability of Winning or Losing Streaks

Understanding the probability of winning or losing streaks is crucial in trading psychology. For instance, if your win rate is 60% and your loss rate is 40%, the probability of consecutive wins or losses is as follows:

- 2 consecutive wins: 60% x 60% = 36%

- 3 consecutive wins: 60% x 60% x 60% = 21.6%

- 4 consecutive wins: 60% x 60% x 60% x 60% = 13%

You can similarly calculate for losing streaks.

5. Drawdowns and Recovery Rates

If you risk 2% of your account per trade and experience 2 consecutive losses, your account won’t decline by 4%, but rather 3.96%.

Formula:

Drawdown = 1 - [(1 - 0.02) x (1 - 0.02)] = 3.96%

For 3 consecutive losses:

Drawdown = 1 - [(1 - 0.02) x (1 - 0.02) x (1 - 0.02)] = 5.88%

The challenge with large drawdowns is the recovery required to get back to break-even. For example, if your account is down 70%, you need a 233% gain to recover fully.

6. Profitability Check

To assess profitability, you can use the relationship between the win ratio and the risk/reward ratio.

Formula:

Required win rate = 1 / (1 + Risk/Reward ratio)

Example:

If you have a 5:1 risk/reward ratio, the required win rate = 1 / (1 + 5) = 1/6 = 16.7%

Professional traders often increase their risk/reward ratio while accepting a lower win rate.

These are some of the essential mathematical formulas that every serious trader should be familiar with when engaging in the cryptocurrency market. While this guide covers the basics, you can explore more advanced calculations as you deepen your understanding of trading.

.png)