Bitcoin has hovered just below the much-anticipated $100,000 milestone, reflecting a strong bull market driven by institutional adoption and significant developments in crypto regulation.

Market Highlights

On Friday, November 22, U.S. equities ended on a positive note, with the Nasdaq leading gains at 0.97%. Meanwhile, gold climbed to $2,718 per ounce, and oil reached $71 per barrel.

Bitcoin remained close to $98,000 throughout the day, flirting with the historic $100,000 level. Altcoins followed Bitcoin’s upward momentum, pushing the total cryptocurrency market capitalization to $3.5 trillion.

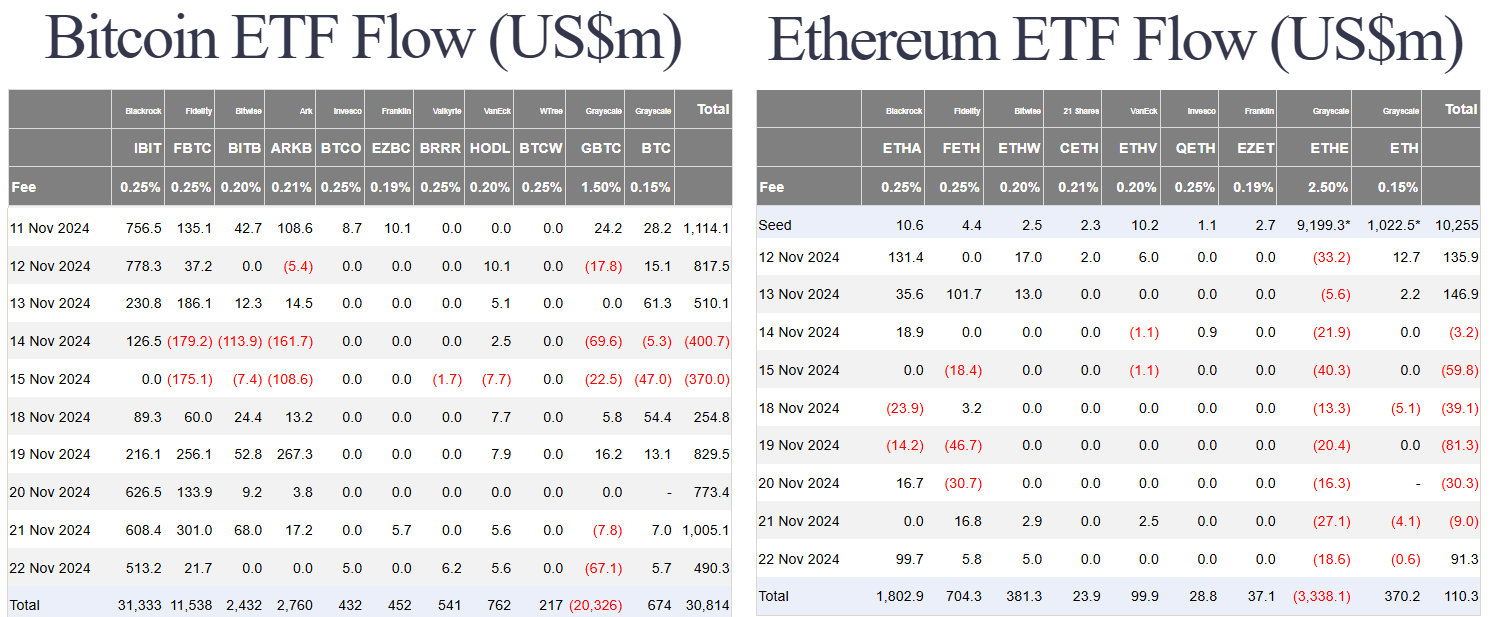

Bitcoin spot ETFs continued to attract substantial inflows, with $490 million entering these funds on Friday. BlackRock’s ETH spot ETF (ETHA) recorded $91 million in net positive inflows after weeks of decline, signaling renewed investor interest in Ethereum.

Bitcoin Inches Closer to $100K

Bitcoin’s steady climb has brought it within striking distance of the $100,000 mark. While the psychological barrier has yet to be breached, the current momentum indicates a potential breakthrough. Analysts attribute this rise to increased institutional adoption, favorable regulatory developments, and broader economic factors such as a weakening U.S. dollar.

Institutional Support Remains Strong

MicroStrategy, a pioneer in institutional Bitcoin adoption, continues to attract attention. The company has recently issued zero-interest bonds maturing in 2029, with major financial players like Vanguard, BlackRock, and Allianz among its key subscribers. This move underscores confidence in Bitcoin's long-term value proposition.

MicroStrategy Highlights:

- Recently sold $3 billion in bonds to fund additional Bitcoin purchases.

- Allianz purchased 25% of MicroStrategy's 2031 convertible bonds, reflecting growing institutional interest in Bitcoin-backed securities.

Key U.S. Regulatory Developments

As the transition to Donald Trump’s presidency unfolds, key appointments are expected to reshape crypto regulations.

Treasury Secretary Nominee

Scott Bessent, a hedge fund manager with a pro-crypto stance, is rumored to be Trump’s choice for Treasury Secretary. Bessent views Bitcoin as a cornerstone for future economic growth and believes it can attract younger investors and foster financial inclusion.

SEC Changes

SEC Chair Gary Gensler is set to resign in January 2025, paving the way for a crypto-friendlier leadership. Teresa Goody Guillén, known for her supportive stance on blockchain technology, is a top candidate for the role. Guillén’s recent statement, "Make Crypto Great Again," has resonated strongly with the crypto community.

Additionally, SEC Commissioner Jaime Lizárraga's resignation further shifts the agency’s balance toward pro-crypto policies, offering hope for less stringent regulatory frameworks.

CFTC Advances Crypto Adoption

The CFTC has proposed allowing tokenized assets to be used as collateral for derivatives trading. If approved, this could include BlackRock’s BUIDL and Franklin Templeton’s FOBXX tokens, adding flexibility and legitimacy to crypto-based financial instruments.

CFTC Commissioner Summer Mersinger also advocates for updated DeFi regulations, emphasizing the need for clearer registration processes to support innovation.

Bitcoin as a Pension Fund Stabilizer

Bitcoin-backed loans are emerging as an innovative financial tool for pension funds. This model combines traditional assets, like real estate, with Bitcoin as collateral, offering higher returns with reduced risk.

How It Works:

- Structured Loans: Combine property and Bitcoin as collateral, reducing reliance on traditional securities.

- Risk Mitigation: The long-term performance of Bitcoin, coupled with insurance-backed loans, minimizes volatility.

- Pension Fund Benefits: Addresses funding gaps by diversifying investments and improving risk-adjusted returns.

This strategy demonstrates Bitcoin's potential to transform traditional finance while offering stability to pension funds.

Additional Crypto Developments

MetaMask Enhances User Experience

MetaMask introduced its Gas Station feature, enabling users to swap tokens without requiring ETH for gas fees. This functionality simplifies onboarding for new users, though its long-term impact on ETH demand remains to be seen.

FTX Repayment Plan

FTX has announced plans to repay $6.6 billion to creditors starting March 2025. This follows the recovery of $16 billion through litigation and restructuring efforts.

Bitcoin ETF Options

Cboe Global Markets plans to list the first cash-settled Bitcoin ETF options, expanding institutional access to cryptocurrency trading.

As Bitcoin approaches the $100K milestone, the crypto market is poised for transformative growth, driven by institutional adoption, innovative financial models, and favorable regulatory shifts. While volatility persists, the long-term outlook remains overwhelmingly positive.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly speculative and carry significant risks. Always consult with a financial advisor before making any investment decisions.

.png)